Key Takeaways for South Florida Home Buyers and Sellers

The real estate market is a complex and ever-changing landscape that can be difficult to navigate. As we move through 2023, it's more important than ever for buyers and sellers in South Florida to understand the intricacies of the market. This blog aims to provide a comprehensive breakdown of key insights from a recent industry webinar. From understanding the psychology of the market to leveraging home equity, we'll cover everything you need to know to make informed real estate decisions in South Florida.

The Inventory Conundrum

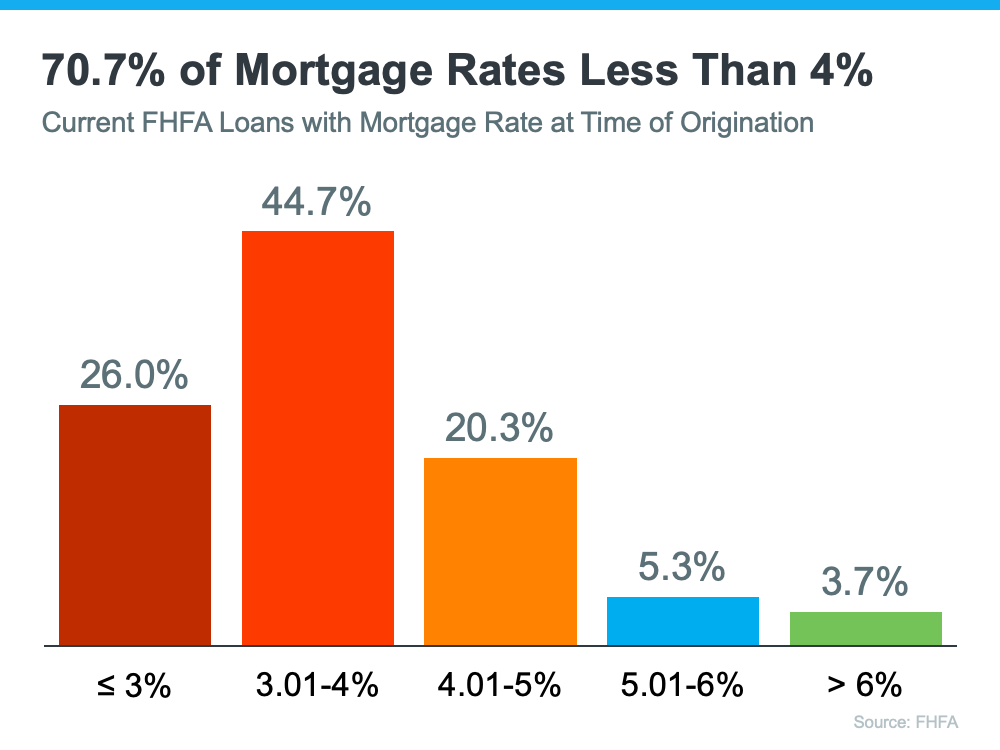

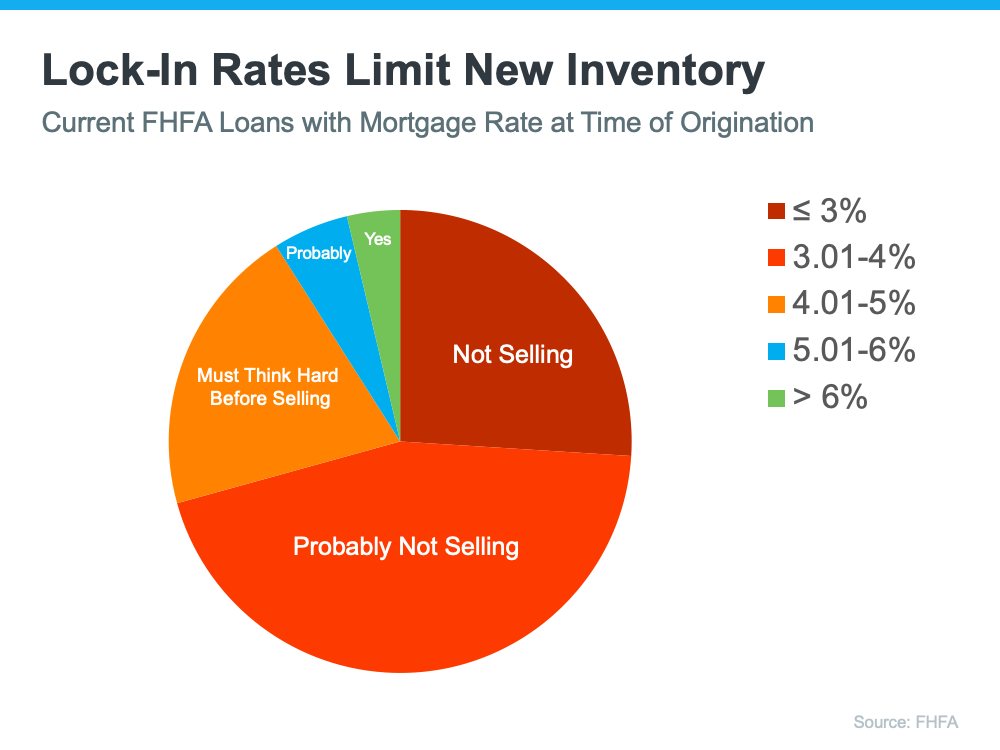

Inventory—or the lack thereof—is one of the most talked-about issues in today's real estate market. Many homeowners are reluctant to sell due to low mortgage rates. This trend is particularly noticeable in South Florida, where the market has been hot for several years. However, life events like divorce, job relocations, or family expansion often necessitate a move, regardless of mortgage rates. For sellers in Broward and Palm Beach County, this could be an opportune time to list your property. With high demand and low supply, sellers are in a position to command top dollar for their homes. Additionally, the scarcity of inventory means that well-priced homes are likely to receive multiple offers, creating a favorable environment for sellers.

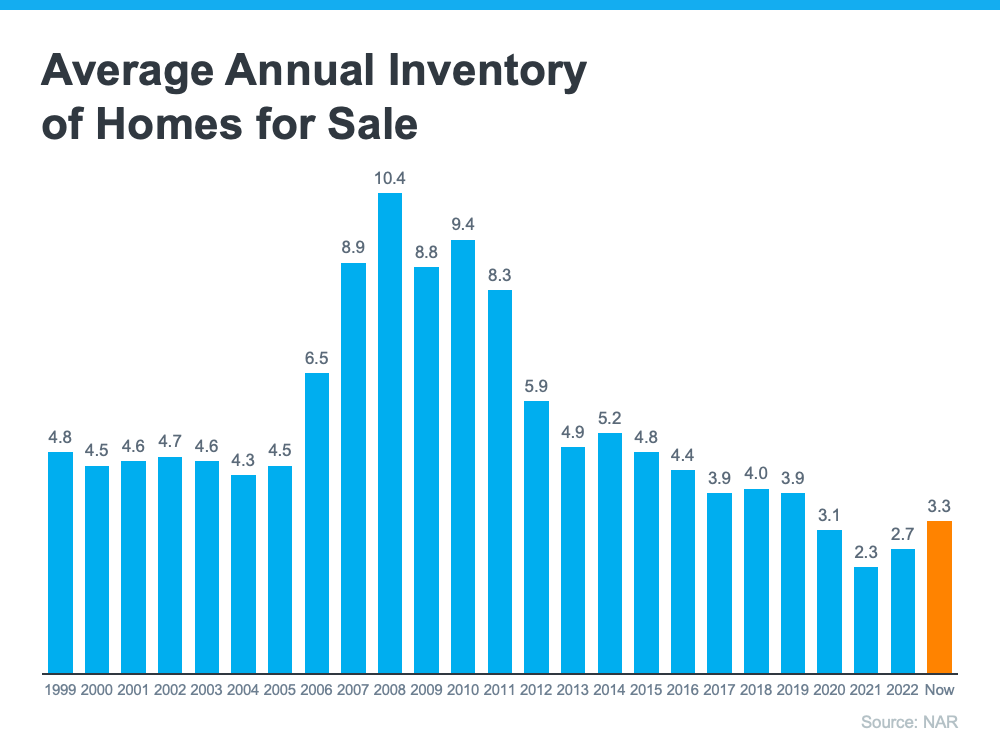

A balanced market is considered around 6 months of inventory. We are currently well below where we need to be to be considered balanced.

As of July 2023, nationally there is 3.3 months of inventory. We would need 2.7 additional months of inventory to be in a balanced market.

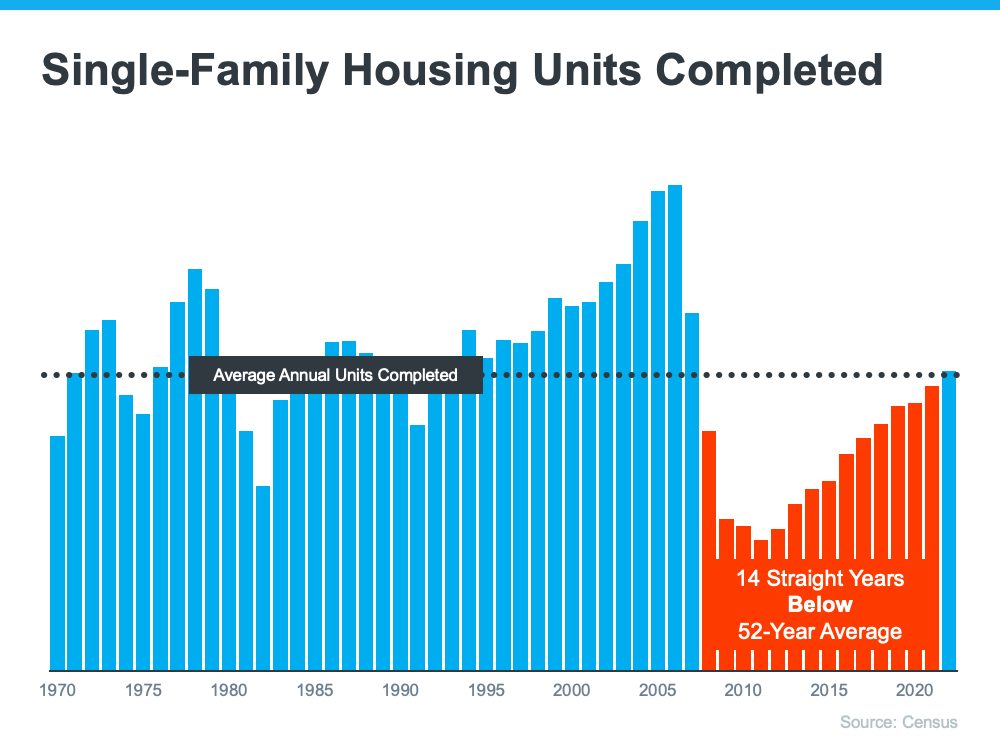

Builders consistantly built fewer homes than the 52 year average over the last 14 years. This trend is now starting to change nationally and more homes are being built. Because of the country's growing population this is sorely needed. Unfortunately much of that development isn't happening in South Florida due to our lack of available land to build.

Between 1985 to 2009, the average American stayed in their home for just over 6 years. Now the average person stays in their home for just over 9 years. Because of this trend we continue to see fewer homes hitting the market as people don't move as frequently.

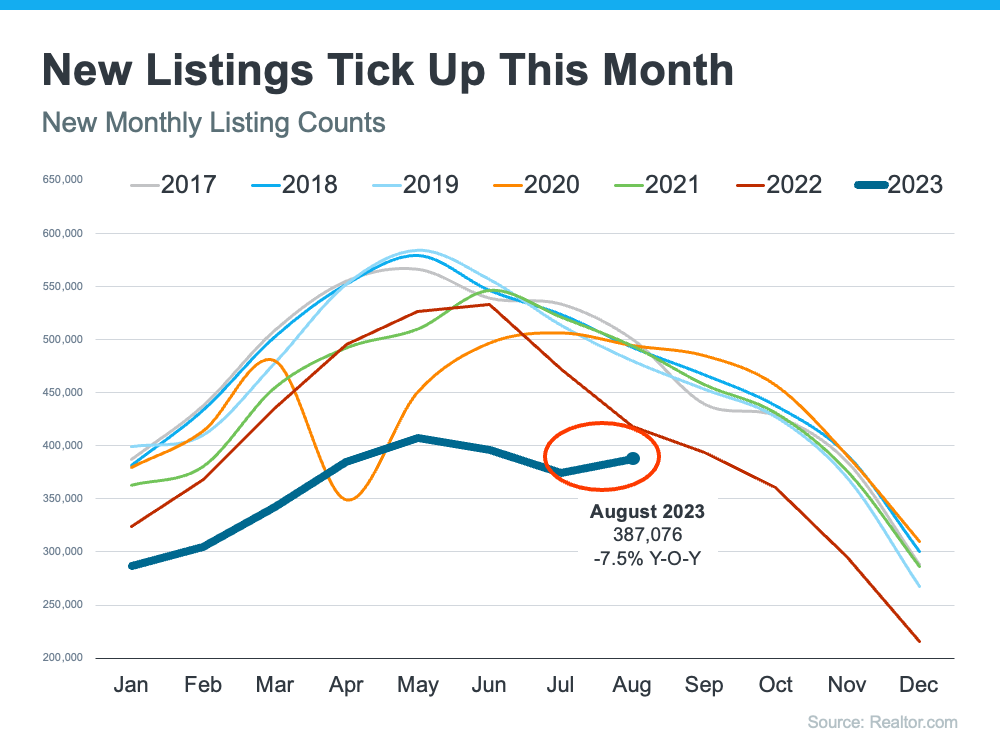

Comparing August 2023 to August in the years prior to the pandemic, you can see in all categories we are significantly lower in inventory.

The Mortgage Rate Dilemma

Mortgage rates have always been a significant factor influencing real estate decisions. 26% of U.S. homeowners say that high mortgage rates would not impact their decision to sell their home. In South Florida, where property values have been on the rise, many homeowners have built significant equity. This equity can offset the impact of higher mortgage rates when buying a new home. Moreover, South Florida attracts a diverse range of buyers, including international investors and retirees, who may not be as sensitive to mortgage rate fluctuations. This creates a more dynamic and resilient market, less susceptible to the ups and downs of mortgage rates.

The Power of Home Equity

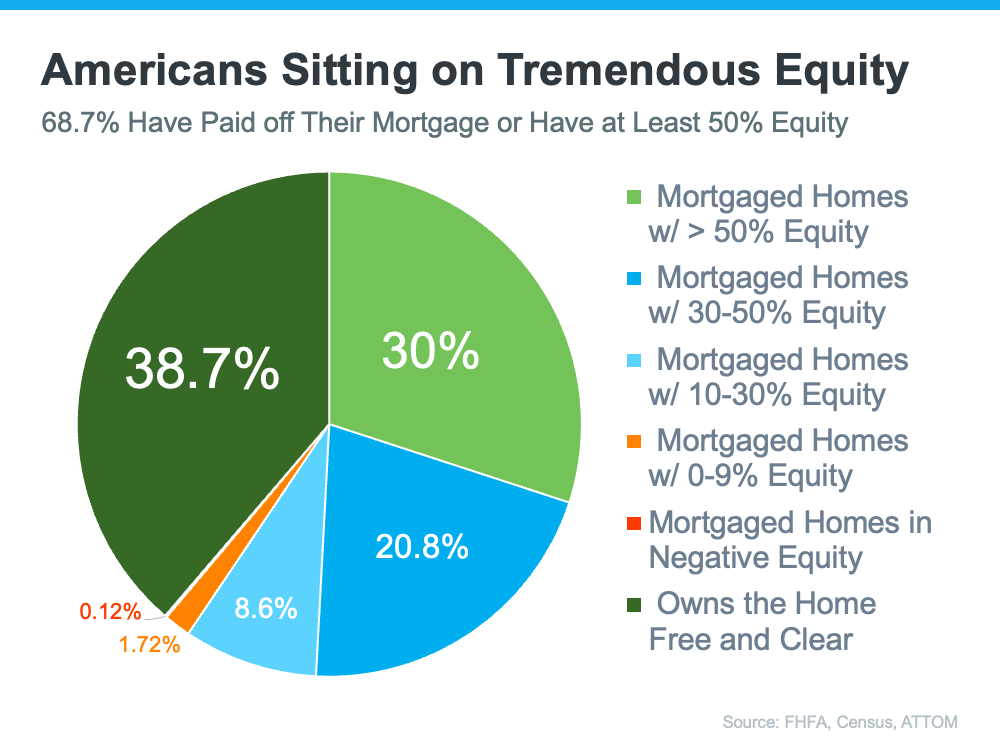

Home equity is often overlooked but is a powerful tool for homeowners. 38.7% of homeowners own their homes free and clear, and another 30% have more than 50% equity. In South Florida, where property values have surged in recent years, many homeowners find themselves in a favorable equity position. This allows for a sizable down payment on a new property, mitigating the impact of higher mortgage rates. For those looking to downsize, relocate, or even invest in a second property, this could be an opportune time to leverage that equity. The high equity positions also open doors for refinancing options, which can be a strategic move for long-term homeowners.

The Psychology of the Market

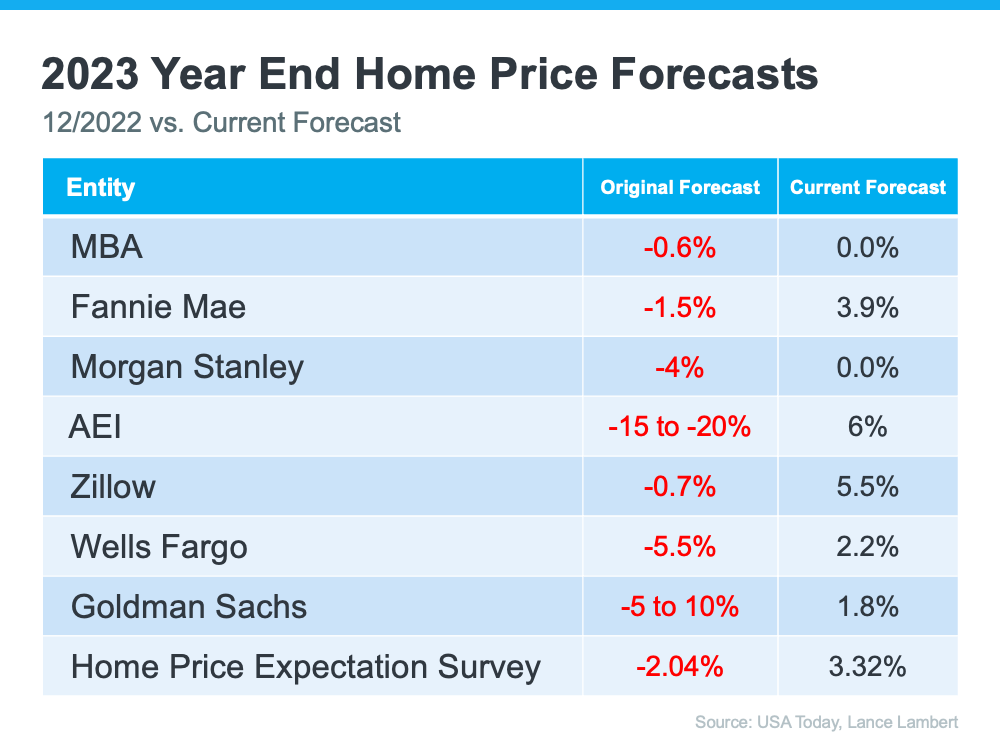

Earlier in the year, 67% of people thought there would be a housing crash. Such perceptions can lead to market paralysis, where potential buyers and sellers hold off on making decisions due to fear. In South Florida, where real estate is often seen as a solid long term investment, dispelling these myths is crucial. Real estate professionals have a moral obligation to educate their clients, alleviating fears and providing factual information to guide decision-making. This is particularly important in South Florida, where the market can be volatile and subject to rapid changes. Accurate, timely information can be the difference between capitalizing on an opportunity and missing out. Luckily, people's perception of what will happen in the market is changing and there is more positive sentiment lately than there was at the end of last year.

The Role of Real Estate Agents

In South Florida the real estate market can be particularly complex due to its diverse range of properties and clientele. It's more important than ever to hire a great real estate agent in South Florida.

The Future Outlook

We are returning to a more normal rate of home price appreciation, which is good for market stability. In South Florida, this could mean a more sustainable growth rate, making it a favorable environment for both buyers and sellers. Future surveys may show an upward adjustment in home price expectations for 2024, providing a longer-term perspective for those considering entering or exiting the market. This is particularly relevant for South Florida, where long-term planning is essential due to the area's susceptibility to economic and environmental factors.

Conclusion

The real estate market in 2023 is complex but navigable. With fluctuating mortgage rates, inventory shortages, and varying home prices, understanding the current trends is crucial for making informed decisions. Whether you're looking to buy or sell in South Florida, a knowledgeable real estate agent is your best ally in navigating this intricate landscape. By staying educated and understanding the market dynamics, you can make decisions that are not just financially sound but also aligned with your life goals. As we move through 2023, staying informed and working with trusted professionals will be key to successfully navigating the South Florida real estate market.

Posted by Andy Mandel on

Leave A Comment