While the prospect of mortgage rates exceeding 8% has garnered attention, it's unlikely to bring about a seismic shift in the housing landscape.

Affordability Concerns

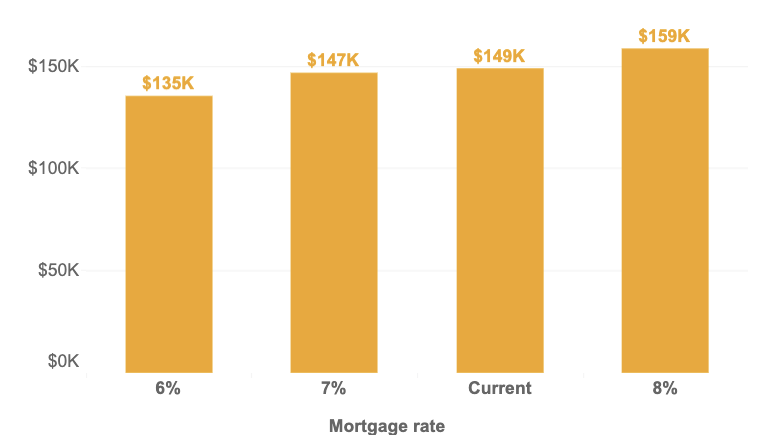

In today's market in South Florida, a household income of approximately $159,000 is needed to afford an average home with 8% interest rates assuming a 10% down payment. This is particularly relevant for South Florida, where the cost of living can be higher than other regions and the "average home" starts at a much higher price than many parts of the country.

The Real Solution: More Homes

The ultimate remedy for enhancing housing affordability lies in increasing the supply of homes. This is especially pertinent for Broward and Palm Beach Counties, where the demand for single-family homes remains robust. Unfortunately in South Florida due to land constraints, there really isn't enough land to build homes on and this problem is going to continue to get worse over time.

A 15-Year Low in Affordability

Housing affordability is at its lowest point in over a decade. The rapid price growth spurred by the pandemic has made down payments more challenging, and the recent uptick in mortgage rates has added to the monthly financial burden for many homeowners.

Interest Rate Buy Downs

A great solution for this problem are mortgage programs called 2-1 Buy Downs or 3-2-1 Buy Downs. With these programs, you have to qualify for today's rate - lets assume 8% - but the Seller can offer to pre-pay some of your interest for 2 or 3 years at closing. For a 3-2-1 Buy Down on a $700,000 house in South Florida putting down 10%, that fee from the Seller would be $30,211. This program drops your interest rate by 3% in year 1, 2% in year 2, and 1% in year 3 making your payments based on 5%, then 6%, then 7% before finally resetting at 8%.

This would reduce your payments in year 1 by $1,240 per month, $845 per month in year 2, and $431 per month in year 3. This should buy time until the market rates drop at which point the Buyer can refinance the home and permanently lock in a lower rate.

If you had just reduced the price by $30,000 it would only reduce your monthly payment by $198 per month. These programs are substantially better for Buyers and can help a home that is having a hard time selling sell faster.

The Seller's Perspective

Higher mortgage rates also have implications for sellers. Many homeowners are choosing to stay put because their current mortgage rates are more favorable than what the market is offering. This trend is limiting the number of homes available for sale, thereby intensifying competition among buyers.

Inventory Deficit

Data suggests that homeowners with mortgage rates below 5% are more inclined to retain their current residences. As rates move further away from this threshold, the housing inventory is likely to shrink even more. 80% of homeowners in America either have no mortgage or have a rate under 5%.

Rate Volatility

Rates have been increasing quickly and they are expected to remain elevated and volatile for the foreseeable future. This is something both buyers and sellers in South Florida should keep an eye on.

Silver Linings

Despite these challenges, there are glimmers of hope. We are starting to see more price reductions and fewer bidding wars. Additionally, the construction sector has been active, with the highest number of homes under construction since 1970. This could alleviate some of the pressure on prices and offer more options for buyers.

The Path Forward

While the current data on construction and permitting is encouraging, there's still much to be done. Building more homes remains the most viable long-term solution for improving affordability and expanding homeownership opportunities, especially in high-demand areas like South Florida.

Posted by Andy Mandel on

Leave A Comment