There were so many people screaming about foreclosures in the last year because of the pandemic, saying that the foreclosure numbers were going to explode once forbearance programs ended at the end of 2021. These people were saying the market was gonna crash like 2008 because of the foreclosures, and they were warning people not to buy. Hey, it's Andy with the Mandel Team at RE/MAX and it turns out those alarmists were just wrong just like we predicted, but let's dig into these numbers.

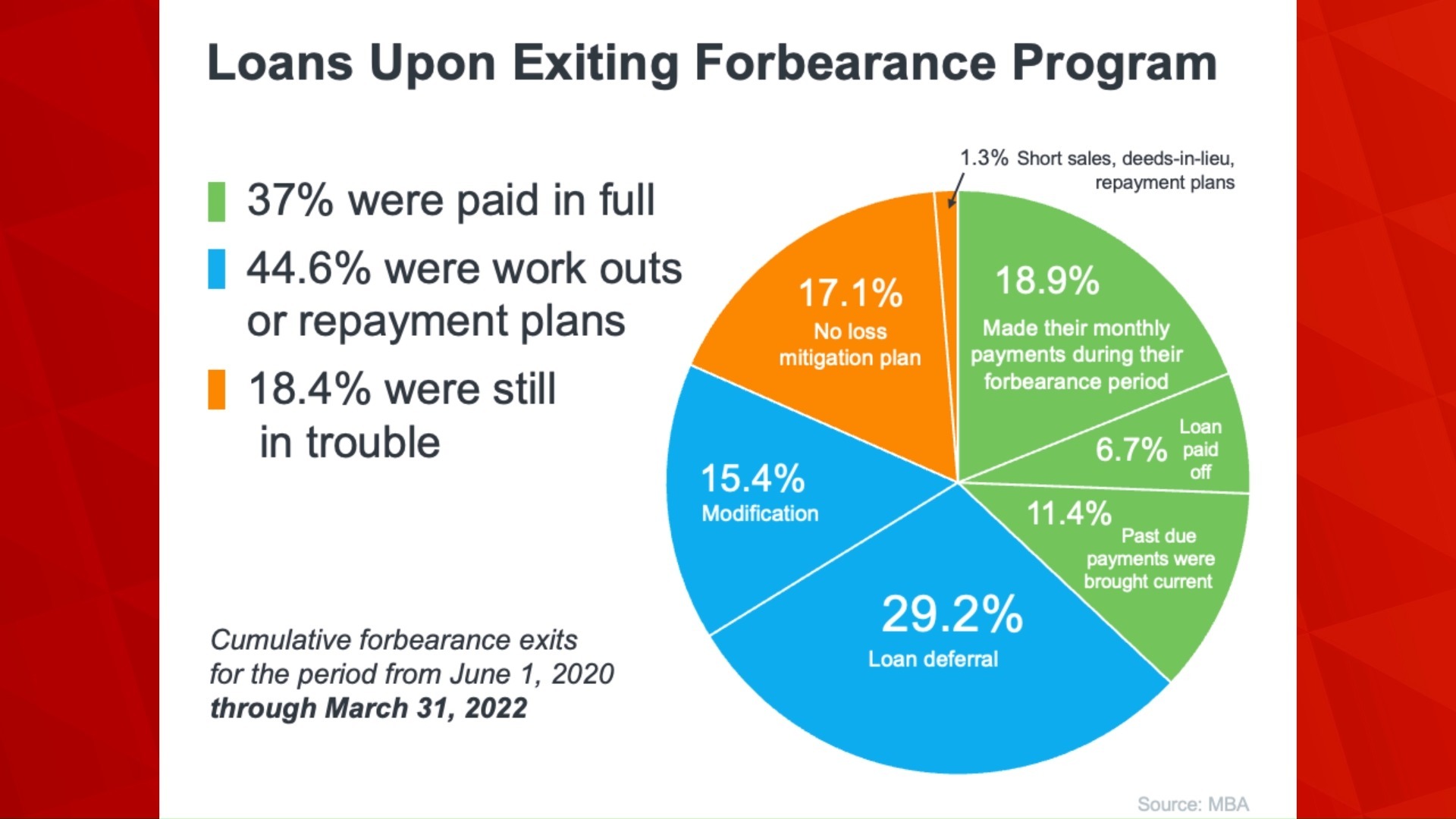

Today's data shows that most homeowners are exiting their forbearance plan either fully caught up on payments or with a plan from the bank that restructured their loan in a way that allowed them to start making payments again. Let's look at the graph. According to the Mortgage Bankers Association, there are approximately 525,000 homeowners who remain in forbearance today. Thankfully, these people still have a chance to work out a suitable repayment plan with the servicing company that represents the lender. Because the housing market has gone up significantly in the last two years, those who are exiting a forbearance program without a plan in place likely have enough equity to sell their homes instead of going into foreclosure. This allows homeowners to walk away with money and not wreck their financial lives like foreclosures did to so many after 2008. These forbearance programs greatly reduce the amount of foreclosures that otherwise would've hit the market.

We all know the sensationalist headlines and clickbait titles are everywhere. It can be really misleading if you don't read the full article with details. While there are more foreclosures now compared to last year when foreclosures were literally paused, the number is still well below what the housing market has seen in a more typical year as you can see in this graph. When the foreclosures in 2008 hit the market, they added to the oversupply of houses that was already for sale. It's the exact opposite today. We are still in a severe shortage of supply in South Florida. And while inventory is starting to pick up slightly, it's still around one month of supply which is a super seller's market. Even pre-pandemic, we were sitting around three and a half months of inventory which is still a seller's market.

A balanced market would have approximately six months of inventory. Even if thousands of homes entered the market in South Florida, there still won't be enough inventory to meet the current demand if nothing changes on the demand side. Bottom line, if you see headlines about the increasing number of foreclosures today, remember, the context is important. While it's true the number of foreclosures is higher now than it was last year. Foreclosures are still well below pre-pandemic years. If you have questions, let's connect to talk you through the latest market conditions and what they mean for you.

Posted by Andy Mandel on

Leave A Comment